Effective July 1, 2021, remote sellers and marketplace providers will be required to register and collect Florida sales and use tax if, in the previous calendar year beginning with calendar year 2020, they have taxable remote sales in which the sum of the sales prices exceeds $100,000.įlorida defines “remote sale” as a “retail sale of tangible personal property ordered by mail, telephone, the Internet, or other means of communication from a person who receives the order outside of this state and transports the property or causes the property to be transported from any jurisdiction, including this state, to a location in this state.” Remote sellers and marketplace facilitators that meet the economic nexus threshold are relieved of tax liability, penalty, and interest due on remote sales that occurred before Jas long as the remote seller or marketplace facilitator registers with the Florida Department of Revenue before October 1, 2021. Wayfair decision, Florida has finally revised its sales tax nexus standards by enacting economic and marketplace nexus legislation.

When You Need to Register Once You Exceed the Threshold: Next transaction (state doesn’t specify)Īpproaching three years after the South Dakota v. Includable Transactions: Taxable sales Marketplace sales excluded from the threshold for individual sellers That said, each state’s threshold is slightly different so it is vital to understand the thresholds in all 44 states.Florida Enacts Economic and Marketplace Nexus Legislation This does not apply if the dealer is under audit is under an administrative or judicial proceeding as of Jor has been issued a bill, notice, or demand for payment.Īt this point, the only other state that imposes a state sales tax that does not have an economic nexus provision is Missouri, so it is only a matter of time until all states impose some kind economic nexus for sales and use tax purposes. There is also a safe harbor provision that relieves a dealer of any tax, interest and penalty due on sales prior to Jif it registers with the Department of Revenue before October 1, 2021. The law goes into effect on July 1, 2021, so if one’s sum of taxable sales during 2020 exceeded $100,000, then the dealer is required to register and begin collecting Florida sales tax on taxable sales made into Florida on or after July 1, 2021. Marketplace providers must certify to the marketplace sellers that it will collect sales tax on its behalf. The marketplace seller must also exclude sales made through a marketplace facilitation on its tax return. The marketplace seller should not include sales made through the marketplace facilitator in determining whether it has exceeded the $100,000 threshold. The same thresholds apply to marketplace providers and marketplace sellers.

So unlike some other states, nontaxable sales and sales of services are not included with total sales to determine whether the threshold has been exceeded. “Remote sales” only includes retail sales of tangible personal property delivered into the state. A “substantial number of remote sales” is defined as any number of taxable remote sales in the previous calendar year where the sum of the sales price exceeds $100,000. Under Florida’s new law, every person with a substantial number of remote sales into the state is considered a “dealer” and required to collect and remit sales tax. On April 19, 2021, Governor Ron DeSantis signed S.B.50 that enacted legislation imposing a sales tax collection requirement on both remote sellers and marketplace providers. Supreme Court’s decision in South Dakota v.

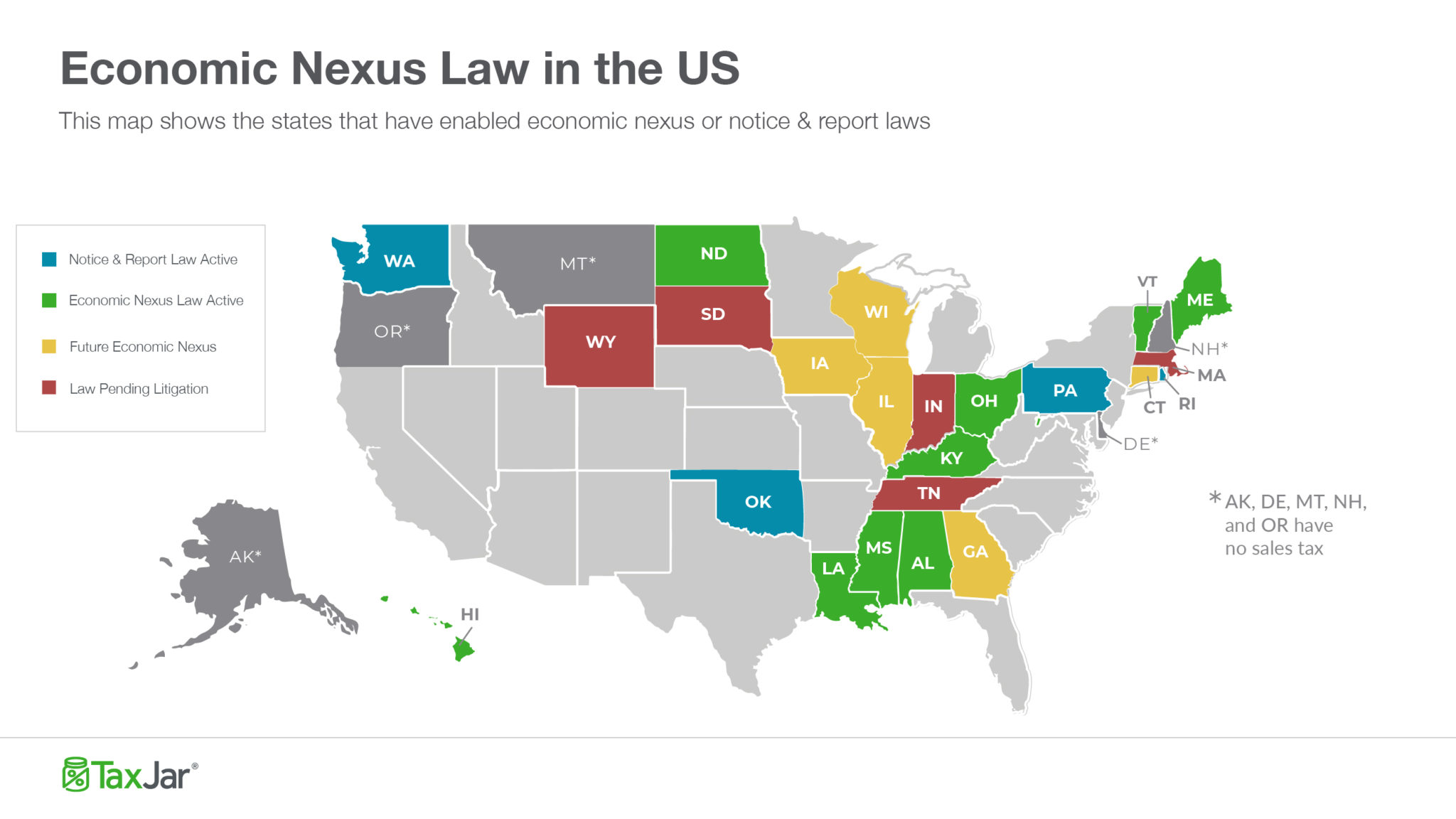

After several years of failed bills, Florida has finally joined the other 43 states that have passed economic nexus threshold for sales and use tax purposes in the wake of the U.S.

0 kommentar(er)

0 kommentar(er)